Money and Finance

My interest in dividends began during a previous job in which I helped manage the portfolios of ultra-high net worth individuals.

In many cases, the account owners had bought their stocks decades earlier, never touched them, reinvested their dividends, and were now living off the dividends from those investments without needing to touch the principal. The principal was then typically passed onto children and grand-children who were always, of course, appreciative of grandpa's or grandma's wise investment decisions.

This approach to investing was radically different from what I had previously understood investing to be -- that is, trading and taking bets on the next "big" thing. Patient dividend investing seemed a much more reasonable (and rational) approach for an individual investor and the bulk of my own investments today remain aligned with this valuable strategy.

As I learned more about dividend investing, I came across a number of academic studies and books that suggested that the vast majority of long-term returns from stocks were attributable to dividends. Indeed, these studies fit nicely with my experiences working with the wealthy investors who harnessed the power of dividends to build their family fortunes.

Looking more closely at these studies, however, I found that they assumed 100% dividend reinvestment, which overstates the contribution of dividends to long-term returns.

Earth to the ivory tower...

The 100% reinvestment assumption is simply not practical. Taxes, for one, can prevent full reinvestment as can commissions, the inability to reinvest in fractional shares, and an investor's decision to spend or save the dividend rather than reinvest it.

A 2011 paper by Legg Mason's Michael Mauboussin sheds much light on this topic and correctly emphasizes the distinction between the equity rate of return (price appreciation plus dividend yield) and the capital accumulation rate (returns including reinvested dividends).

Mauboussin provides two helpful formulas to help us understand the math behind total shareholder return (TSR).

1.) TSR = g + (1+g)*d

Where:

g = the annual price appreciation rate

d = dividend yield

This TSR formula assumes 100% reinvestment of dividends and is likely the one used in the previously referenced academic studies. To illustrate, a stock that's growing at 7% per year and has a 4% starting dividend yield should generate TSR of 11.28% annualized (0.07 + (1 + 0.07)*0.04).

TSR equals the capital accumulation rate (CAR) only when there's 100% reinvestment. The following formula shows the CAR when there isn't 100% dividend reinvestment. It's the same formula as the first, with a slight modifier that incorporates rate of reinvestment.

2.) CAR = g + (1+g)*d*r

Where:

r = % reinvested

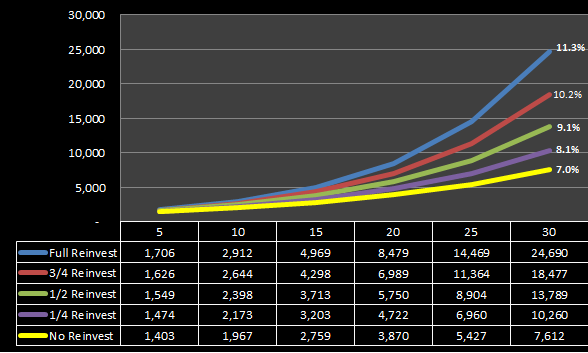

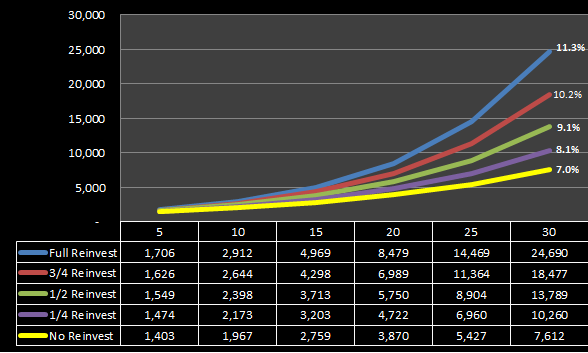

To show how various rates of reinvestment can dramatically affect long-term returns, the following chart and table assume a $1,000 investment in a stock with a starting dividend yield (d) of 4% and annual price appreciation rate (g) of 7% at various rates of reinvestment over time.

As you can see, anything less than full reinvestment results in a lower CAR, and price appreciation rather than dividends accounts for a larger and larger percentage of the results. If the investor chooses to reinvest nothing and instead chooses to consume the dividend, the only source of growth is price appreciation.

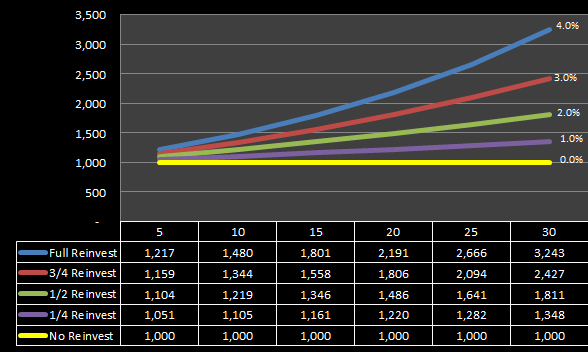

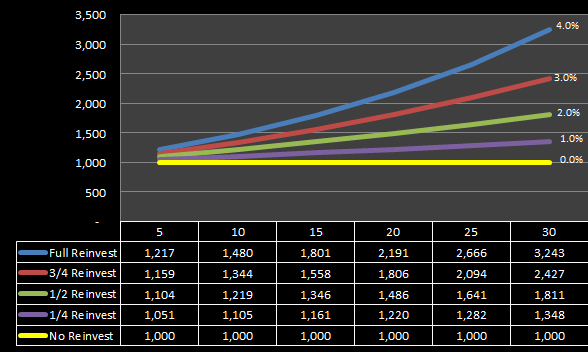

To further illustrate the importance of price appreciation in returns, let's assume an annual price appreciation rate (g) of 0% at various rates of reinvestment.

Over 30 years assuming 100% reinvestment, a $1,000 investment in a stock with an initial dividend yield of 4% and price appreciation of 7% will be worth $24,690; if price appreciation is 0% it will be worth $3,243. When there's no price growth, you're just purchasing additional shares.

In other words, while we can clearly see the importance of reinvesting dividends in enhancing the benefits of compounding growth, we can also see that price appreciation matters more than the oft-cited studies suggest.

This isn't a dividend downer

By no means should this be taken as a knock on the power of dividends. Rather, it shows that investors also need to pay attention to price appreciation and valuation. Dividends alone don't drive returns.

While the academic studies over-emphasize and perhaps misrepresent the contribution of dividends to long-term shareholder returns, the studies remain an important part of the discourse about dividends and illustrate quite clearly how dividends enhance the benefits of compounding growth. Their lessons should still be heeded.

The more fully you can reinvest each dividend received, the higher your potential longer-term returns. A few ways that you can maximize your reinvestment rate are to hold your dividend paying stocks in tax-advantaged accounts like IRAs (US) and ISAs (UK), to compare your broker's reinvestment fees (if any) and policies (do they allow fractional reinvestment?) versus others, and to evaluate your reinvestment strategy.

Thanks for reading! Please post any questions or comments below.

Best,

Todd

@toddwenning on Twitter

Note: In the original post, I mislabeled CAR in the second formula and in the examples. It has now been updated. Apologies for the confusion.

- Reinvest Or Pool?

As a dividend growth investor one of the first things you must decide is whether you want to automatically reinvest your dividends or collect them until and add them to new investment capital. There's advantages and disadvantages to both. The...

- Little Green George Washingtons

I believe that in the long term dividend growth stocks will provide solid returns while being less volatile than the market in general. It's not flashy and it's not a get rich quick scheme. However, when 40% of the long term total return on stocks...

- A Simple Formula For Investing Success

The best time to plant a tree was 20 years ago. The second best time is now. - AnonymousInvesting is simple, but not easy. - Warren Buffett When my wife and I lived in England, we had the pleasure of visiting her relatives in a small village in Gloucestershire...

- 5 Keys To Reinvesting Dividends

Once you've decided to build a dividend-based portfolio, it's essential to know what you're going to do with the income generated by your investments. There are three basic options -- spend the dividend, save it, or reinvest it. Sounds...

- Dividend Reinvestment

Hi Everyone, I was thinking about what I have left out with regards to my investing style and it hit me: I have not discussed whether or not I reinvest dividends or I "bank" the money and use it all at once to purchase another stock that I feel...

Money and Finance

An Important Misunderstanding About Dividends

My interest in dividends began during a previous job in which I helped manage the portfolios of ultra-high net worth individuals.

In many cases, the account owners had bought their stocks decades earlier, never touched them, reinvested their dividends, and were now living off the dividends from those investments without needing to touch the principal. The principal was then typically passed onto children and grand-children who were always, of course, appreciative of grandpa's or grandma's wise investment decisions.

This approach to investing was radically different from what I had previously understood investing to be -- that is, trading and taking bets on the next "big" thing. Patient dividend investing seemed a much more reasonable (and rational) approach for an individual investor and the bulk of my own investments today remain aligned with this valuable strategy.

As I learned more about dividend investing, I came across a number of academic studies and books that suggested that the vast majority of long-term returns from stocks were attributable to dividends. Indeed, these studies fit nicely with my experiences working with the wealthy investors who harnessed the power of dividends to build their family fortunes.

Looking more closely at these studies, however, I found that they assumed 100% dividend reinvestment, which overstates the contribution of dividends to long-term returns.

Earth to the ivory tower...

The 100% reinvestment assumption is simply not practical. Taxes, for one, can prevent full reinvestment as can commissions, the inability to reinvest in fractional shares, and an investor's decision to spend or save the dividend rather than reinvest it.

A 2011 paper by Legg Mason's Michael Mauboussin sheds much light on this topic and correctly emphasizes the distinction between the equity rate of return (price appreciation plus dividend yield) and the capital accumulation rate (returns including reinvested dividends).

Mauboussin provides two helpful formulas to help us understand the math behind total shareholder return (TSR).

1.) TSR = g + (1+g)*d

Where:

g = the annual price appreciation rate

d = dividend yield

This TSR formula assumes 100% reinvestment of dividends and is likely the one used in the previously referenced academic studies. To illustrate, a stock that's growing at 7% per year and has a 4% starting dividend yield should generate TSR of 11.28% annualized (0.07 + (1 + 0.07)*0.04).

TSR equals the capital accumulation rate (CAR) only when there's 100% reinvestment. The following formula shows the CAR when there isn't 100% dividend reinvestment. It's the same formula as the first, with a slight modifier that incorporates rate of reinvestment.

2.) CAR = g + (1+g)*d*r

Where:

r = % reinvested

To show how various rates of reinvestment can dramatically affect long-term returns, the following chart and table assume a $1,000 investment in a stock with a starting dividend yield (d) of 4% and annual price appreciation rate (g) of 7% at various rates of reinvestment over time.

As you can see, anything less than full reinvestment results in a lower CAR, and price appreciation rather than dividends accounts for a larger and larger percentage of the results. If the investor chooses to reinvest nothing and instead chooses to consume the dividend, the only source of growth is price appreciation.

To further illustrate the importance of price appreciation in returns, let's assume an annual price appreciation rate (g) of 0% at various rates of reinvestment.

Over 30 years assuming 100% reinvestment, a $1,000 investment in a stock with an initial dividend yield of 4% and price appreciation of 7% will be worth $24,690; if price appreciation is 0% it will be worth $3,243. When there's no price growth, you're just purchasing additional shares.

In other words, while we can clearly see the importance of reinvesting dividends in enhancing the benefits of compounding growth, we can also see that price appreciation matters more than the oft-cited studies suggest.

This isn't a dividend downer

By no means should this be taken as a knock on the power of dividends. Rather, it shows that investors also need to pay attention to price appreciation and valuation. Dividends alone don't drive returns.

While the academic studies over-emphasize and perhaps misrepresent the contribution of dividends to long-term shareholder returns, the studies remain an important part of the discourse about dividends and illustrate quite clearly how dividends enhance the benefits of compounding growth. Their lessons should still be heeded.

The more fully you can reinvest each dividend received, the higher your potential longer-term returns. A few ways that you can maximize your reinvestment rate are to hold your dividend paying stocks in tax-advantaged accounts like IRAs (US) and ISAs (UK), to compare your broker's reinvestment fees (if any) and policies (do they allow fractional reinvestment?) versus others, and to evaluate your reinvestment strategy.

Thanks for reading! Please post any questions or comments below.

Best,

Todd

@toddwenning on Twitter

Note: In the original post, I mislabeled CAR in the second formula and in the examples. It has now been updated. Apologies for the confusion.

- Reinvest Or Pool?

As a dividend growth investor one of the first things you must decide is whether you want to automatically reinvest your dividends or collect them until and add them to new investment capital. There's advantages and disadvantages to both. The...

- Little Green George Washingtons

I believe that in the long term dividend growth stocks will provide solid returns while being less volatile than the market in general. It's not flashy and it's not a get rich quick scheme. However, when 40% of the long term total return on stocks...

- A Simple Formula For Investing Success

The best time to plant a tree was 20 years ago. The second best time is now. - AnonymousInvesting is simple, but not easy. - Warren Buffett When my wife and I lived in England, we had the pleasure of visiting her relatives in a small village in Gloucestershire...

- 5 Keys To Reinvesting Dividends

Once you've decided to build a dividend-based portfolio, it's essential to know what you're going to do with the income generated by your investments. There are three basic options -- spend the dividend, save it, or reinvest it. Sounds...

- Dividend Reinvestment

Hi Everyone, I was thinking about what I have left out with regards to my investing style and it hit me: I have not discussed whether or not I reinvest dividends or I "bank" the money and use it all at once to purchase another stock that I feel...